Ondas Holdings Reports Second Quarter 2023 Financial Results

- Preston Grimes

- Aug 14, 2023

- 13 min read

Record revenues of $5.5 million in Q2 2023 with over 800% growth driven by both Ondas Networks and Ondas Autonomous Systems business units

Strengthened balance sheet with $25 million in capital raised from private and institutional investors in Q3

OAS entered new partnerships to distribute the Optimus System in the US, India and Saudi Arabia

Conference Call Scheduled for Today at 8:30 a.m. ET

WALTHAM, MA / ACCESSWIRE / August 14, 2023 / Ondas Holdings Inc. (Nasdaq:ONDS) ("Ondas" or the "Company"), a leading provider of private industrial wireless networks and commercial drone and automated data solutions, reported financial and operating results for the second quarter ended June 30, 2023.

"Ondas continues to demonstrate accelerating growth, highlighted by record revenues of $5.5 million in the second quarter," said Eric Brock, Ondas' Chairman, CEO and President. "This momentum has allowed us to strengthen our balance sheet with $25 million in growth capital from private and institutional investors. We believe Ondas is well positioned to continue driving adoption of our platform technologies across both Ondas Networks and Ondas Autonomous Systems (OAS) and ramp production to fulfill expected order growth over the next twelve to eighteen months."

"At Ondas Networks, we had another record revenue quarter driven by shipments for customers. We are working actively with Siemens and the Class I Rails to further prepare for large-scale commercial deployments at 900 MHz. This activity is driving a growing order pipeline, and despite some recent production bottlenecks, we believe we are ready to deliver against an expected increase in customer demand."

"OAS also recorded record revenues while continuing to demonstrate leadership with customers as we define solutions around public safety, drone as a first responder and smart city use cases. In addition to our activity in the United Arab Emirates (UAE), we have created new opportunities internationally which are highlighted by the recent announcements of our entrance into both India with our partner Aero A2Z and the Kingdom of Saudi Arabia via a strategic alliance with Saudi Excellence. We are also making significant progress in bringing the Optimus System to US markets, as evidenced by our recent announcements with MassDOT Aeronautics and Skyfire Consulting. Our customer pipeline is growing in all key verticals and globally."

Q2 2023 and Recent Highlights - Ondas Networks Revenues, Shipments and Development Progress

Delivered $1.5 million in product and development revenue in the second quarter with a new record delivery in product shipments to Siemens

Secured $15 million in financing from Charles & Potomac LLC with the final closing on August 11th; funding provides working capital to accelerate production, fulfill backlog and support the growth plan

Engaged new contract manufacturer to increase production capacity and enhance Ondas Networks ability to address an expected increase in customer orders

Ondas Networks and Siemens are in advanced planning and negotiations with certain Class I railroads for volume orders related to the 900 MHZ network

Continued development progress on the rail industry Network Controller for optimizing frequency usage along with new peer-to-peer technology to support advanced rail applications

Continued to support MxV Rail and the Association of American Railroads (AAR) for the integration of applications on 900 MHz

Supporting the initial installation for a vital, mission-critical communications link at a rail crossing for a Class I Rail on 900 MHz

Advanced the development program for Siemens' new on-locomotive radio platform in Europe

Responded to two major network proposals to supply radio platforms for passenger and transit carriers on the US Northeast Rail Corridor

Stewart Kantor, Ondas Networks Founder, President and CFO, commented, "Ondas Networks has seen a significant increase in field activity as planning and contract negotiations progress with customers since the selection of IEEE 802.16 for the 900 MHz network by the rail industry. With the $15 million investment in Ondas Networks announced in July, we are now investing for large-scale production capacity by leveraging highly qualified contract manufacturers. We feel we are well positioned to capitalize on the growth opportunity ahead."

Q2 2023 and Recent Highlights - Ondas Autonomous Systems (OAS) Customer & Financial Activity

Delivered $4.0 million of revenue in Q2 driven by success with customers in the UAE

Airobotics successfully completed a proof-of-concept (PoC) program with the Optimus Urban Drone Infrastructure at an industrial facility in Abu Dhabi in June 2023; completion of the program with OAS's UAE-based partner SkyGo was a significant milestone in advancing a $3.5 million multi-system deal previously announced in February 2023

Airobotics secured a renewed and expanded annual service agreement for ongoing maintenance of the Optimus Systems currently operated by a local government entity in Dubai where Optimus has conducted thousands of flights over highly populated areas; the new service agreement includes ongoing support services and the development of new features that will be implemented across the installed fleet of the Optimus Urban Drone Infrastructure across the city of Dubai

American Robotics secured a fully funded agreement with Massachusetts Department of Transportation Aeronautics Division (MassDOT Aeronautics) to implement autonomous drone technology across the state of Massachusetts; this PoC program commences in the second half of 2023 and is intended to showcase the capabilities of the Optimus System for data collection and safety of critical infrastructure operators in key areas such as rail inspections, port operations, wetlands assessments, and incident response while reducing operational expenses for multiple state entities

Strategic Activity

The US Federal Aviation Administration (FAA) approved the noise certification standards for the Optimus-1EX system, the final major step towards completing the Type Certification process that will allow the Optimus System to operate more broadly in urban environments in the US

American Robotics entered a strategic partnership with Skyfire Consulting whereby Skyfire will bring the Optimus System advanced autonomous drone solutions and services to public safety and Drone First Responder (DFR) markets in the US where Skyfire is focused on supporting first responders, military, US Department of Defense (DOD), and critical infrastructure through the use of drone technology, and specifically, DFR programs

OAS expanded into the Kingdon of Saudi Arabia (KSA) as Airobotics entered into Strategic Alliance Agreement with Saudi Excellence whereby the companies agreed to jointly establish a KSA office in order to localize and develop an ecosystem around Airobotics autonomous drone operations and provide aerial data solutions to local governmental and commercial entities

OAS expanded into the Indian market via a strategic partnership between Airobotics and Aero A2Z Services Pvt. Ltd., an Indian vendor specialized in technology, aviation, and defense; Aero A2Z Services will offer Optimus System Unmanned Aerial Systems (UAS) and Iron Drone Counter-UAS (C-UAS) solutions for smart cities, government, and industrial entities in India

Eric Brock was named to the Board of Directors of the Commercial Drone Alliance (CDA); the CDA advocates for the commercial use of drones and promotes US global leadership in advanced aviation

OAS President Meir Kliner commented, "Ondas Autonomous Systems had a strong quarter executing across several fronts including expanded commercial activity in the UAE, Israel, and now in India and Saudi Arabia with our recently announced in country partnerships. In addition, we are making considerable progress in opening the US market for Optimus as we move closer to receiving Type Certification for our Optimus platform from the FAA. As we enter the domestic US market, we see demand with government and industrial markets including oil and gas and believe partnerships such as our recently announced deal with Skyfire Consulting to enter public safety and DFR markets will be helpful in driving faster and broader adoption."

Second Quarter 2023 Financial Results

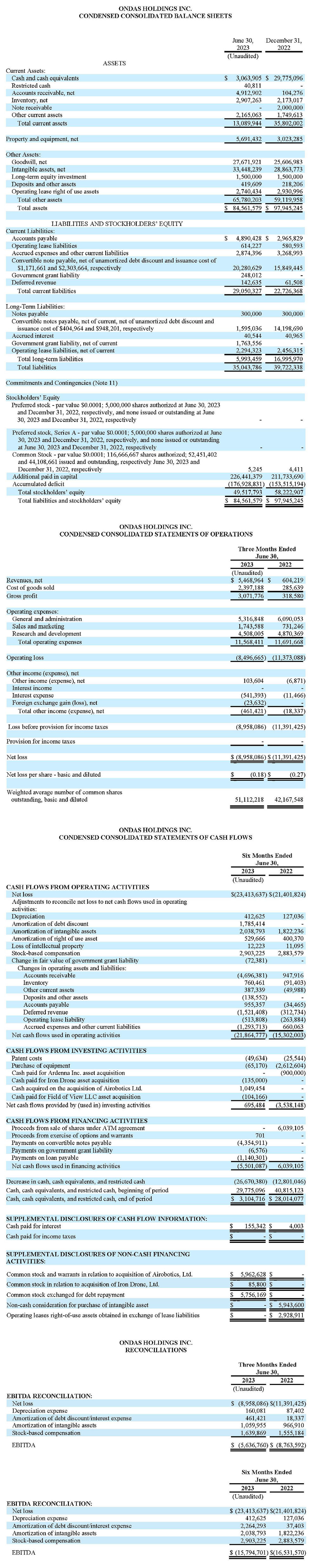

Revenues increased to $5.5 million for the three months ended June 30, 2023, compared to $0.6 million for the three months ended June 30, 2022. The more than 800% increase in revenue was primarily due to significantly higher product revenues as customers adopt our technology platforms at both Ondas Networks and OAS.

Gross profit increased to $3.1 million for the three months ended June 30, 2023, compared to $0.3 million for the three months ended June 30, 2022. Gross margin improved to 56.2% for the three months ended June 30, 2022, compared to 52.7% for the three months ended June 30, 2022. The margin is driven by a large proportion of high margin product sales in the revenue mix. Gross margins can be volatile on a quarter-to-quarter basis due to low revenue levels and shifts in revenue mix between product, development, and services revenues.

Operating expenses declined to $11.6 million for the three months ended June 30, 2023, as compared to $11.7 million for the three months ended June 30, 2022. This slight decline occurred despite elevated expenses relating to the addition of Airobotics and the establishment of our OAS business unit that were not incurred in the second quarter of 2022 and reflects the reduction in operating costs and expense controls at OAS after the Airobotics acquisition and integration in January 2023 which continued into the second quarter. Cash operating expenses during the second quarter of 2023 equaled $8.8 million when excluding non-cash operating expenses during the period including $1.6 million in stock-based compensation and $1.2 million in depreciation and amortization.

The Company realized an operating loss of $8.5 million for the three months ended June 30, 2023, compared to a loss of $11.4 million for the three months ended June 30, 2022. The lower operating loss was primarily driven by the increases in revenues and gross profits from product sales and also reflected lower costs at OAS due to the integration of American Robotics and Airobotics. This was partially offset by Ondas Networks as investments in operations were increased in anticipation of product orders.

Net loss was $9.0 million for the three months ended June 30, 2023, as compared to a net loss of $11.4 million for the three months ended June 30, 2022. The lower net loss was primarily driven by the increases in revenues and gross profits from product sales and reflected lower costs at OAS due to the integration of American Robotics and Airobotics.

Excluding non-cash expenses, the Company realized an EBITDA loss of $5.6 million for the three months ended June 30, 2023, as compared to $8.8 million for the three months ended June 30, 2022.

First Half 2023 Financial Results

Revenues increased to $8.1 million for the six months ended June 30, 2023, compared to $1.0 million for the six months ended June 30, 2022. The more than 700% increase in revenue was primarily due to significantly higher product revenues as customers adopt our technology platforms at both Ondas Networks and OAS.

Gross profit increased to $4.1 million for the six months ended June 30, 2023, compared to $0.4 million for the six months ended June 30, 2022. Gross margin improved to 50.8% for the six months ended June 30, 2023, compared to 43.5% for the six months ended June 30, 2022. The margin is driven by a large proportion of high margin product sales in the revenue mix.

Operating expenses were $25.2 million for the six months ended June 30, 2023, compared to $21.8 million for the six months ended June 30, 2022. This increase is largely due to elevated costs at American Robotics, prior to the integration of Airobotics and the establishment of our Ondas Autonomous Systems business unit in January 2023. Restructuring costs, including costs to terminate certain development programs at American Robotics, and non-recurring professional fees related to the Airobotics acquisition also contributed to elevated expenses in the first half of 2023. Cash operating expenses during the first half of 2023 equaled $19.9 million when excluding non-cash operating expenses during the period including $2.9 million in stock-based compensation and $2.4 million in depreciation and amortization.

The Company realized an operating loss of $21.1 million for the six months ended June 30, 2023, compared to a loss of $21.4 million for the six months ended June 30, 2022. The stable operating loss, despite a significant increase in revenue and gross profit, reflects the higher costs in the first quarter of 2023 which included elevated and non-recurring costs related to the acquisition of Airobotics and the establishment of the OAS business unit.

Net loss was $23.4 million for the six months ended June 30, 2023, compared to a net loss of $21.4 million for the six months ended June 30, 2022. While revenues and gross profits were higher year-over-year, the increased loss was due to both elevated expenses in the first quarter related to the Airobotics acquisition and OAS integration, and higher interest costs related to the convertible notes issued in October 2022.

Excluding non-cash expenses, the Company realized an EBITDA loss of $15.8 million for the six months ended June 30, 2023, as compared to $16.5 million for the six months ended June 30, 2022. The lower EBITDA loss was the result of an increase in revenue and gross profits in the first half of 2023.

The Company held cash and cash equivalents of $3.1 million as of June 30, 2023, compared to $29.8 million as of December 31, 2022. The decline in cash and cash equivalents is the result of operating losses incurred during the first half of 2023 in addition to $5.5 million of cash used to repay debt and $6.1 million of cash used for an increase in working capital. Subsequent to June 30, 2023, the Company raised $25.0 million in gross cash proceeds through the sale of convertible notes and Ondas Networks preferred stock. Pro forma for these financings and net of transaction expenses, the Company would have had $27.1 million of cash as of June 30, 2023.

Operational and Financial Outlook for 2023

Ondas has lowered its revenue outlook for the full year 2023 from the original $26 million to $30 million target range due to a slower than expected ramp in systems production at Ondas Networks. The slower production ramp was related to component availability challenges that were exacerbated working capital limitations which created bottlenecks to ordering long lead time components. Ondas Networks believes that recent improvements in component availability and the engagement of a highly qualified contract manufacturer, along with the $15 million working capital provided by the recently announced financing, will allow for production to reaccelerate in the second half of 2023 and into 2024. Increased systems production is expected to coincide with an increase in expected purchase orders from Siemens on behalf of rail customers.

OAS remains on track to meet its original revenue growth objectives for 2023, which will be supported by continued customer engagement in the UAE as well as new customer activity expected in the US and other key global markets. Growth in the US is expected to be further supported by the expected receipt of the FAA's Type Certification for the Optimus System in the third quarter of 2023.

For the second half of 2023, Ondas expects to generate at least $7.0 million in revenue across its business units resulting in a full year 2023 revenue target of $15 million, a more than 6-fold increase over full year 2022 revenues of $2.1 million. We continue to expect substantial growth in 2024 as commercial adoption scales at both Ondas Networks and OAS.

Revenue growth is expected to fluctuate quarter-to-quarter given the uncertainty around the timing of customer activity, both related to orders and equipment production in connection with the commercial rollout for the 900 MHz Rail network and the timing of OAS's orders and deliveries to the UAE and US customers.

Earnings Conference Call & Audio Webcast Details

Date: Monday, August 14, 2023

Time: 8:30 a.m. Eastern time

Toll-free dial-in number: 844-883-3907

International dial-in number: 412-317-5798

Call participant pre-registration link: here

The Company encourages listeners to pre-register, which allows callers to gain immediate access and bypass the live operator. Please note that you can register at any time during the call. For those who choose not to pre-register, please call the conference telephone number 10-15 minutes prior to the start time, at which time an operator will register your name and organization.

The conference call will also be broadcast live and available for replay here and via the investor relations section of the Company's website at ir.ondas.com. A replay will be accessible from the investor relations website after completion of the event.

About Ondas Holdings Inc

Ondas Holdings Inc. ("Ondas") is a leading provider of private wireless data solutions via Ondas Networks Inc. ("Ondas Networks") and commercial drone solutions through American Robotics, Inc. ("American Robotics" or "AR") and Airobotics LTD ("Airobotics"), which we operate as a separate business unit called Ondas Autonomous Systems.

Ondas Networks is a developer of proprietary, software-based wireless broadband technology for large established and emerging commercial and government markets. Ondas Networks' standards-based (802.16s), multi-patented, software-defined radio FullMAX platform enables Mission-Critical IoT (MC-IoT) applications by overcoming the bandwidth limitations of today's legacy private licensed wireless networks. Ondas Networks' customer end markets include railroads, utilities, oil and gas, transportation, aviation (including drone operators) and government entities whose demands span a wide range of mission critical applications.

Our Ondas Autonomous Systems business unit designs, develops, and markets commercial drone solutions via the Optimus System and the Iron Drone Raider™ (the "Autonomous Drone Platforms"). The Autonomous Drone Platforms are highly automated, AI-powered drone systems capable of continuous, remote operation and are marketed as "drone-in-a-box" turnkey data solution services. They are deployed for critical industrial and government applications where data and information collection and processing are required. The Autonomous Drone Platforms are typically provided to customers under a Robot-as-a-Service (RAAS) business model. American Robotics and Airobotics have industry leading regulatory successes which include having the first drone system approved by the FAA for automated operation beyond-visual-line-of-sight (BVLOS) without a human operator on-site. Ondas Networks, American Robotics and Airobotics together provide users in oil & gas, rail, mining, public safety and other critical infrastructure and government markets with improved connectivity and data collection and information processing capabilities.

For additional information on Ondas Holdings, visit www.ondas.com or follow Ondas Holdings on Twitter and LinkedIn. For additional information on Ondas Networks, visit www.ondasnetworks.com or follow Ondas Networks on Twitter and LinkedIn. For additional information on American Robotics, visit www.american-robotics.com or follow American Robotics on Twitter and LinkedIn. For additional information on Airobotics, visit www.airoboticsdrones.com or follow Airobotics on Twitter and LinkedIn.

Information on our websites and social media platforms is not incorporated by reference in this release or in any of our filings with the U.S. Securities and Exchange Commission.

Non-GAAP Financial Measure

As required by the rules of the Securities and Exchange Commission ("SEC"), we provide a reconciliation of EBITDA, the non-GAAP financial measure, contained in this press release to the most directly comparable measure under GAAP, which reconciliation is set forth in the table below.

We believe that EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company's core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. EBITDA should only be used as supplemental measures of our operating performance.

We believe that EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table below, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

Management uses EBITDA in making financial, operating, and planning decisions and evaluating the Company's ongoing performance.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading "Risk Factors" discussed under the caption "Item 1A. Risk Factors" in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption "Item 1A. Risk Factors" in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc. 888.350.9994 x1019 ir@ondas.com

Media Contact for Ondas Preston Grimes Marketing Manager, Ondas Holdings Inc. preston.grimes@ondas.com